A Guide to Nonprofit Accounting for Non-Accountants Bench Accounting

Content

- Resources for Your Growing Business

- Understand Tax Regulations for Nonprofits

- Reports for board meetings (statement of financial position, statement of activity) such as income statement and balance sheet

- SERVICES

- Explain State of Finances to All

- Why On-Time and Trustworthy Financials Are Vital to Your Business

- Find a Nonprofit-Friendly Bookkeeping Solution

- Best for Large Organizations

When bundled with FastFund Accounting, FastFund Fundraising is available for as little as $20 per month, or $42 per month as a standalone product. If you’re responsible for managing the accounting for multiple organizations, such as the school PTA and your child’s sports team, you can use the software to handle the accounting for both at no additional cost. ACCOUNTS https://www.bookstime.com/ through Software4Nonprofits is a program offered by Cooperstock Software, a small company based in Canada. The company was founded by the treasurer of a religious finance committee because he had difficulties finding software that met his needs. He created ACCOUNTS as an alternative to the more expensive and complex accounting programs available at the time.

Is IFRS a non profit?

The IFRS Foundation is a not-for-profit, public interest organisation established to develop high-quality, understandable, enforceable and globally accepted accounting and sustainability disclosure standards.

Ask your bank whether they offer business chequing accounts tailored to nonprofits. Our professional opinion is that the majority of nonprofits will benefit from outsourcing their bookkeeping and accounting needs, working directly with nonprofit accounting experts. It’s an affordable option that can provide access to deep nonprofit accounting experience and expertise. In order to make the best financial decisions, nonprofit professionals should understand some accounting best practices.

Resources for Your Growing Business

When it comes time for their annual financial audit, they may have to halt their efforts in order to create audit-ready books for compliance. Explore three reasons why nonprofits are turning to outsourced bookkeeping services to meet their needs. It’s important that you’re using a bookkeeper and accountant who have experience preparing financial statements for nonprofit organizations. If you do something incorrectly, it could have a damaging effect on your organization. At Good Steward Financial, we offer a full suite of online bookkeeping services for nonprofit organizations. We can provide you with the following services on a monthly basis, whichever suits you the best, helping your 501c3 nonprofit organization save time and resources so that you can focus on your goals.

When you let us handle your nonprofit’s bookkeeping needs, you will be paired with one of our staff bookkeepers whose expertise is best matched to your needs. Rather than focusing on sales, the financial records for any nonprofit must demonstrate the organization’s dedication to its stated charitable purpose through the appropriate use of its resources and assets. Anyone running a nonprofit organization has more important things on their mind than bookkeeping. I’d recommend getting your operating budget approved by the board of directors.

Understand Tax Regulations for Nonprofits

Once you’ve got a bookkeeping system and a bank account in place, you need some way of making sure the information in both of those systems lines up. Gail Sessoms, a grant writer and nonprofit consultant, writes about nonprofit, small business and personal finance issues. She volunteers as a court-appointed child advocate, has a background in social services and writes about issues important to families. Take our 2-minute survey to find out if outsourced accounting and bookkeeping is a good fit for your organization. The top minds in the nonprofit world visit our A Modern Nonprofit Podcast to talk about fundraising, branding your nonprofit, scaling, compliance, and more. We’ll implement new technology and processes to modernize your bookkeeping and improve transparency.

For large nonprofit organizations that have significant accounting needs as well as employees and a large donor-base, Financial Edge can be an excellent fit and it’s our top choice for large organizations. If you want to track donations and donor information, you’ll need to purchase additional software. Cooperstock Software offers another program called DONATIONS, which is free if you have 100 donors or less per year. For most of you, it’s in your best interest to find an outsourced bookkeeping service that specializes in nonprofits. This will allow you to focus on the mission of your nonprofit, without having to worry about managing the books.

Reports for board meetings (statement of financial position, statement of activity) such as income statement and balance sheet

Moreover, we can help you make the right decision regarding QuickBooks and financial software as well as train you in using the software to its fullest capabilities. Contact us today to discuss your nonprofit’s needs and how we can help your national or Connecticut nonprofit. You may be successful in networking with particular software providers who may offer you a discounted rate on software. Otherwise, free accounting options are available but it’s advised that you consult with a professional before making final decisions regarding your nonprofit’s financial software. Financial Edge is a product released by Blackbaud, a leading software company that caters to nonprofit organizations, educational institutions, and healthcare facilities. For large organizations that want enterprise-level accounting, Financial Edge is the clear choice.

The financial position statement gives you a look at that and lets you see what you own, owe, and how much money is left in the pot after. Financial statements give you a clear understanding of how much money you have and how it is being used. Once you have your bookkeeping software set up, we recommend starting to generate financial statements to help guide your business. A statement of activities is the nonprofit’s version of a for-profit’s income statement. It gives a view of a nonprofit’s prosperity over a period of time, expressing revenue minus expenses and losses. A vendor or service provider may lend time or resources, helping your nonprofit as an act of charity.

SERVICES

Your nonprofit budget is the planning document used to predict expenses and allocate resources for your organization. It details both the costs that your organization will incur as well as the revenue you expect to receive over a set period of time, usually a year. Fund accounting enables nonprofits to allocate their money into different groups or “funds” in order to keep them organized and only spend funds on what they’re designated for. The entry should contain information such as the donor’s name, the amount of money, and the date. However, there are several actions all nonprofits need to take to ensure data quality and reliability.

This nonprofit accounting statement breaks down the operating, financing, and investing activities to show how cash moves at the organization. You can easily see how your nonprofit uses the funding it receives from fundraising, grant seeking, and other revenue streams by analyzing this statement. Your nonprofit’s statement of nonprofit bookkeeping services cash flow shows how funding and cash moves in and out of the organization. It allows you to gauge how much is available to pay your expenses at any given time. Luckily, here at Jitasa, we don’t think nonprofit accounting is tedious at all! We’ve loved helping over a thousand organizations organize and maintain their finances.

Explain State of Finances to All

With the simple guidance in this book, you’ll learn how to keep accurate books in accordance with state and federal laws, even if your professional background isn’t in finance. Our belief that every person, business and organization is unique and requires a personalized plan is certainly applicable to the nonprofit sector. We know these organizations have specific challenges when it comes to preparation of financial statements, and we have the experience to solve them. We utilize modern nonprofit accounting software when providing bookkeeping services which ensure that all information is accurate as well as secure.

- As you likely know, nonprofits are not taxed the same as for-profit businesses.

- The reason for this is it not only thanks the donor for the funds, but the donor may be relying on such acknowledgment for personal tax deductions.

- Sometimes foundations or businesses will match any contribution made by employees with a grant.

- This is why we encourage you to learn about the three primary financial statements and utilize a budget.

- For small organizations like churches or community organizations, we selected ACCOUNTS as the best accounting software.

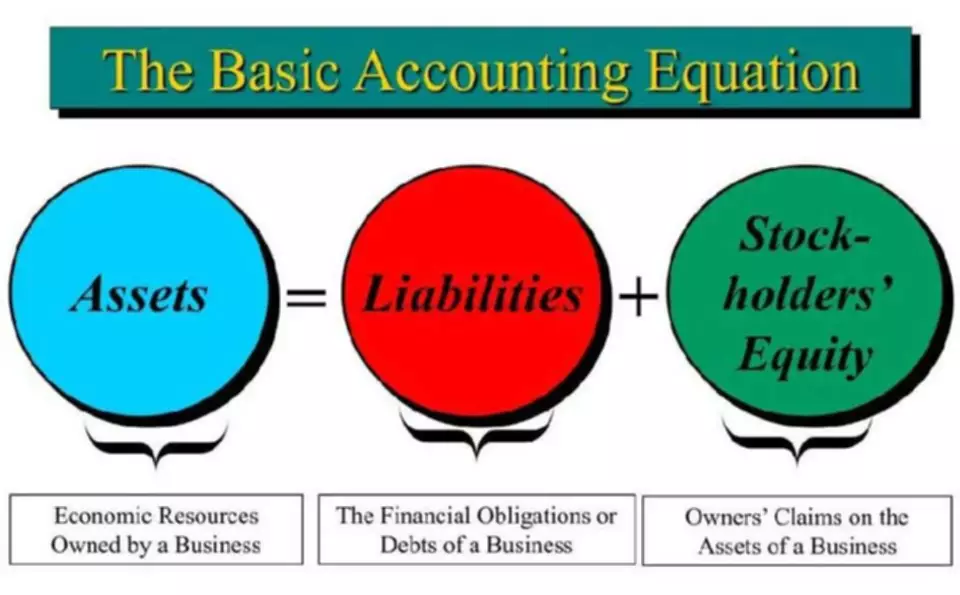

- This is essentially the nonprofit accounting version of the balance sheet equation.

- We also suggest that you find an accounting system that can perform fund accounting.

Filing the annual Form 990 is a key aspect of nonprofit accounting, and one that can’t be overlooked. Form 990 is the annual tax form that tax-exempt (e.g. 501(c)3) organizations are required to file each year to remain compliant with the regulations and requirements set by the IRS. For example, if you have $50,000 of restricted assets set aside for your scholarship program, then decide to provide a $5,000 scholarship, you’re not losing those funds. From tracking payments and expenses to creating reports and quarterly financial statements, FreshBooks is the go-to program with numerous uses. You should also hire a financial officer or a treasurer who knows how to do bookkeeping for a nonprofit and is familiar with specialized accounting software. Supporting Strategies has allowed us to get out of our own way and focus on the long-term strategic financial-planning decisions we need to make.

Why On-Time and Trustworthy Financials Are Vital to Your Business

Due to this love of the craft and experience in the field, we decided to put together this guide to help nonprofits like yours better understand their accounting needs. Nonprofit accounting and bookkeeping revolve around representing an organization’s financial records in compliance with generally accepted accounting principles (GAAP). Your nonprofit accountant can prepare your books, bank accounts, reports and all transactions for a financial audit. They can also recommend you the best nonprofit auditing firm to complete the audit. Pledges are promises made by donors to provide a nonprofit with a donation at a future time-period.

- As a part of your team, Supporting Strategies will bring streamlined processes and enhanced controls to your organization, so you can focus on your mission.

- One of the most important aspects of that process is role delegation, which is why I’m mentioning it separately.

- Unrestricted net assets are any funds your nonprofit has received from donors that have no rules or conditions attached to them, like a pure cash donation.

If your financial officer can abide by these guidelines for bookkeeping, your nonprofit should be in good standing. By getting these systems in place, your nonprofit will be ready to accept, manage, and distribute funds to where they need to go the most. You’ll find more detailed information on some of these sections later on.